UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant §240.14a-12 |

| SONOMA PHARMACEUTICALS, INC. |

| (Name of Registrant as Specified in its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | ||

| ☐ | Fee computed based on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

| 1) | Title of each class of securities to which transaction applies: | ||

| 2) | Aggregate number of securities to which transaction applies: | ||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

| 4) | Proposed maximum aggregate value of transaction: | ||

| 5) | Total fee paid: | ||

| ☐ | Fee paid previously with preliminary materials. | ||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

| 1) | Amount Previously Paid: | ||

| 2) | Form, Schedule or Registration Statement No.: | ||

| 3) | Filing Party: | ||

| 4) | Date Filed: | ||

|

|

|||

Notice of 2022 Annual

|

Thursday,

|

Woodstock, Georgia 30189

(800) 759-9305

Dear Fellow Stockholder:

The Board of Directors takes its role as representative of the Company seriously and believes that accountability and stockholder communication is vital to the ongoing growth of the Company.

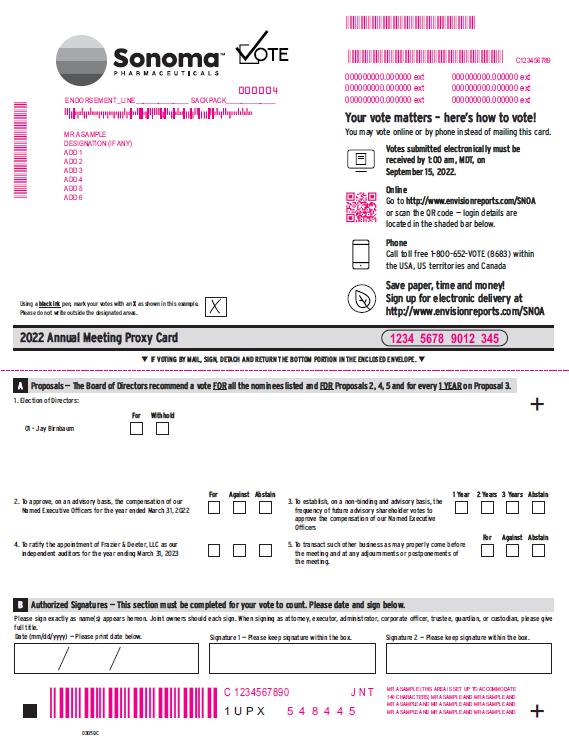

Pursuant to this, you are cordially invited to attend the 2022 Annual Meeting of Stockholders of Sonoma Pharmaceuticals, Inc. The meeting will be held at 2:00 p.m. MDT, on Thursday, September 15, 2022, in our Boulder office at 5445 Conestoga Court, Unit 150, Boulder, CO, 80301.

The formal notice of the 2022 Annual Meeting and proxy statement have been made a part of this invitation.

At this year’s meeting, we will vote on the election of Dr. Jay Birnbaum as Class II director and the ratification of the selection of Frazier & Deeter, LLC as our independent registered public accounting firm. We will also conduct non-binding advisory votes to approve the compensation of our named executive officers and regarding the frequency of future say-on-pay votes. Finally, we will transact such other business as may properly come before the meeting.

Whether or not you attend the Annual Meeting, it is important that your shares are represented and voted at the Annual Meeting. You may vote over the Internet or by telephone or, if you requested printed copies of the proxy materials, by mailing a proxy or voting instruction card. Voting over the Internet, by telephone or by written proxy will ensure your representation at the Annual Meeting regardless of whether you attend the meeting.

The proxy statement and the Annual Report are available at www.envisionreports.com/SNOA and our website at www.ir.sonomapharma.com/annual-reports, by using the QR codes at the end of this document, or by contacting our Investor Relations department through email at ir@sonomapharma.com.

We look forward to seeing you at our Annual Meeting. Thank you for your ongoing support of, and continued interest in Sonoma.

Sincerely,

|

|

| ||

Jay Birnbaum |

Philippe Weigerstorfer |

Jerry McLaughlin |

Notice of 2022 Annual Meeting of Stockholders

Thursday, September 15, 2022, 2:00 p.m., Mountain Time

5445 Conestoga Court, Unit 150, Boulder CO 80301

We are pleased to invite you to join our Board of Directors, management and other stockholders for our 2022 Annual Meeting of Stockholders of Sonoma Pharmaceuticals, Inc. The meeting will be held in our offices located at 5445 Conestoga Court, Unit 150, Boulder, CO 80301, at 2:00 p.m. MDT on Thursday, September 15, 2022. The purposes of the meeting are:

| · | To elect one Class II Director, Dr. Jay Birnbaum, nominated by our Board of Directors, to serve until the 2025 Annual Meeting of Stockholders or until his successor is duly elected and qualified; |

| · | To consider and vote on whether to approve, on an advisory, the compensation of our Named Executive Officers for the fiscal year ended March 31, 2022; |

| · | To vote on a non-binding, advisory resolution to establish the frequency of future advisory shareholder votes to approve the compensation of our Named Executive Officers; |

| · | To ratify the appointment of Frazier & Deeter, LLC as our independent auditors for the fiscal year ending March 31, 2023; and |

| · | To transact such other business as may properly come before the meeting and at any adjournments or postponements of the meeting. |

Our Board of Directors recommends you vote “FOR” the election of one director nominee, the approval of our executive compensation, and the ratification of our independent auditors, and “1 YEAR” for the frequency of future votes on executive compensation.

Only stockholders of record at the close of business on July 22, 2022 are entitled to notice of and to vote at the Annual Meeting and any adjournments or postponements thereof. For ten days prior to the Annual Meeting, a complete list of stockholders entitled to vote at the Annual Meeting will be available for inspection at the Company’s principal executive offices, 645 Molly Lane, Suite 150, Woodstock, Georgia 30189.

All stockholders are cordially invited to attend the Annual Meeting in person. Whether or not you plan to attend, please vote your shares by telephone or by the Internet as promptly as possible. Telephone and Internet voting instructions can be found on the notice card. Should you receive more than one proxy because your shares are registered in different names and addresses, each proxy should be signed and returned to assure that all your shares will be voted. You may revoke your proxy at any time prior to the Annual Meeting. If you attend the Annual Meeting and vote in person, your proxy will be revoked and only your vote in person at the Annual Meeting will be counted.

The Proxy Statement and our Annual Report for the fiscal year ended March 31, 2022, are available at www.envisionreports.com/SNOA or http://ir.sonomapharma.com/annual-reports. You can also access these materials by scanning the QR codes on the last page of this Proxy Statement, or by contacting our Investor Relations department by email at ir@sonomapharma.com.

| By Order of the Board of Directors, | |

| |

| Bruce Thornton | |

| Chief Operating Officer and Corporate Secretary | |

| Woodstock, Georgia |

Your Vote is Important to us. Regardless of whether you plan to attend, we urge all stockholders to vote on the matters described in the accompanying Proxy Statement. We hope that you will promptly vote and submit your proxy by dating, signing and returning the enclosed proxy card. This will not limit your rights to attend or vote at the Annual Meeting.

General Voting and Meeting Information

This Proxy Statement and accompanying form of proxy are being mailed to stockholders on or about August 3, 2022. All proxy materials will also be made available via www.envisionreports.com/SNOA. It is important that you carefully review the proxy materials and follow the instructions below to cast your vote on all voting matters.

Voting Methods

Even if you plan to attend the Annual Meeting in person please vote as soon as possible by using one of the following advance voting methods.

Voting via the Internet or by telephone helps save money by reducing postage and proxy tabulation costs.

|

VOTE BY INTERNET*

|

1. Read this Proxy Statement. 2. Go to the applicable website listed on your proxy card or voting instructions form. 3. Have this Proxy Statement, proxy card, or voting instruction form in hand and follow the instructions.

|

|

VOTE BY TELEPHONE*

|

1. Read this Proxy Statement. 2. Call the number listed on your proxy card or voting instructions form. 3. Have this Proxy Statement, proxy card, or voting instruction form in hand and follow the instructions.

|

|

VOTE BY MAIL |

1. Read this Proxy Statement. 2. Fill out, sign and date each proxy card or voting instruction form you receive and return it in the prepaid envelope.

|

*If you are a beneficial owner you may vote via the telephone or internet if your bank, broker, or other nominee makes those methods available, in which case they will include the instructions with the proxy materials. If you are a stockholder of record, Sonoma will include instructions on how to vote via internet or telephone directly on your proxy voting card.

We encourage you to register to receive all future shareholder communications electronically, instead of print. This means that access to the annual report, proxy statement, and other correspondence will be delivered to you via e-mail.

| 1 |

Voting at the Annual Meeting

Stockholders of record may vote at the Annual Meeting. Beneficial owners may vote in person if they have a legal proxy from their brokerage firm, bank, or custodian. Beneficial owners should contact their bank or brokerage account representative to learn how to obtain a legal proxy. We encourage you to vote your shares in advance of the Annual Meeting by one of the methods described above, even if you plan on attending the Annual Meeting.

Voting Matters and Board Recommendations

Stockholders are being asked to vote on the following matters at the 2022 Annual Meeting:

| Proposal | Recommendation |

| PROPOSAL 1 - Election of Director | FOR |

Election of one Class II director nominee, Dr. Jay Birnbaum. The Board believes that the nominee’s knowledge, skills, and abilities would positively contribute to the function of the Board as a whole.

|

|

| PROPOSAL 2 - Advisory Vote to Approve Executive Compensation | FOR |

The Say-on-Pay Proposal, to approve, on a non-binding advisory basis, the compensation paid to the Named Executive Officers for the year ended March 31, 2022, as described below in the section entitled “Compensation Overview.” The Company has designed its compensation programs to reward and motivate employees to continue to grow the Company. The Compensation Committee takes stockholder views seriously and will take into account the advisory vote in future executive compensation decisions.

|

|

| PROPOSAL 3 - Advisory Vote on Frequency of Say-on-Pay | 1 YEAR |

|

This proposal gives our stockholders the opportunity to cast an advisory, non-binding vote, in accordance with Section 14A of the Exchange Act, on how often we should include advisory say-on-pay votes (that is, votes similar to Proposal 2 in this proxy statement) in our proxy materials for our future annual stockholders’ meetings or any special stockholders’ meeting for which we must include Named Executive Officer compensation information in the proxy materials. Stockholders may vote their preference to have future advisory say-on-pay votes once every year, once every two years, or once every three years. If you have no preference, you may choose to abstain from voting on this proposal. The Board believes that holding an annual advisory say-on-pay vote is the most appropriate option for our Company because it will allow our stockholders to provide us with their input on our compensation philosophy, policies and practices as disclosed in the Proxy Statement on a timely basis. The Board therefore recommends stockholders vote “1 Year” for this Proposal.

|

|

| PROPOSAL 4 – Ratification of the Appointment of Independent Registered Public Accounting Firm | FOR |

|

The Audit Committee has appointed Frazier & Deeter, LLC as our Independent Registered Public Accounting Firm for the fiscal year ending March 31, 2023. The Audit Committee and the Board believe that the retention of Frazier & Deeter, LLC is in the best interests of the Company and its stockholders.

|

| 2 |

| 1. | What is a proxy statement, what is a proxy and how does it work? |

A proxy statement is a document that the U.S. Securities and Exchange Commission requires us to give you when we ask you to sign a proxy card designating someone other than you to vote the stock you own. The written document you sign indicating who may vote your shares of common stock is called a proxy card and the person you designate to vote your shares is called a proxy. The Board of Directors is asking to act as your proxy. By signing and returning to us the proxy card enclosed you are designating us as your proxy to cast your votes at the Annual Meeting. We will cast your votes as you indicate on the enclosed proxy card.

Our employees, officers, and directors may solicit proxies. We will bear the cost of soliciting proxies and will reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable, out-of-pocket expenses for forwarding proxy and solicitation material to the owners of our common stock.

| 2. | Who is entitled to vote at the Annual Meeting of Stockholders? |

Only stockholders who were Sonoma Pharmaceuticals, Inc. stockholders of record at the close of business on July 22, 2022, or the Record Date, may vote at the 2022 Annual Meeting. As of the close of business on the Record Date, there were 3,099,270 shares of our common stock outstanding. Each stockholder is entitled to one vote for each share of our common stock held as of the Record Date.

| 3. | What is the difference between a stockholder of record and a beneficial owner? |

If your shares are registered directly in your name with Sonoma’s transfer agent, Computershare, Inc., you are considered, with respect to those shares, a stockholder of record. As a shareholder of record, you will receive a notice regarding the availability of the Proxy Statement, Annual Report, and proxy card directly from us.

If your shares are held in a brokerage account or by a bank or other nominee, you are considered a beneficial owner of your shares. As a beneficial owner, you will receive a notice regarding the availability of the Proxy Statement, Annual Report, and voting instruction form forwarded to you by your broker, bank, or nominee who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker, bank, or nominee how to vote your shares by using the voting instruction form included in the mailing. If you do not give instructions to your bank or brokerage firm, it will nevertheless be entitled to vote your shares with respect to “routine” items, but will not be permitted to vote your shares with respect to “non-routine” items. In the case of a non-routine item, your shares will be considered “broker non-votes” on that proposal.

| 4. | What does it mean if I receive more than one proxy card? |

If you hold your shares in multiple registrations, or in both registered and street name, you will receive a proxy card for each account. Please mark, sign, date, and return each proxy card you receive. If you choose to vote by telephone or Internet, please vote each proxy card you receive.

| 5. | Will there be any other items of business on the agenda? |

We do not expect any other items of business because the deadline for stockholder proposals and nominations has already passed. Nonetheless, in case there is an unforeseen need, the accompanying proxy gives discretionary authority to the persons named on the proxy with respect to any other matters that might be brought before the meeting. Those persons intend to vote that proxy in accordance with their best judgment.

| 3 |

| 6. | How will my shares be voted? |

To designate how you would like to vote, fill out the proxy card indicating how you would like your votes cast. If you sign and return the enclosed proxy, but do not specify how to vote, we will vote your shares as follows:

| · | “FOR” Proposal No. 1 to elect one Class II director nominee, Dr. Jay Birnbaum; |

| · | “FOR” Proposal No. 2, the Say-on-Pay Proposal, to approve on a non-binding advisory basis, the compensation paid to our Named Executive Officers for the fiscal year ended March 31, 2022; |

| · | “1 YEAR” on Proposal No. 3 on the frequency of the Say-on-Pay proposal; |

| · | “FOR” Proposal No. 4 to ratify the appointment of Frazier & Deeter, LLC as our independent registered public accounting firm for the fiscal year ending March 31, 2023. |

| 7. | Can I change my vote or revoke my proxy? |

You may change your vote or revoke your proxy at any time prior to the vote at the Annual Meeting. If you submitted your proxy by mail, you must file with our Secretary, at Sonoma Pharmaceuticals, Inc., 645 Molly Lane, Suite 150, Woodstock, GA 30189, a written notice of revocation or deliver a valid, later-dated proxy. If you submitted your proxy by telephone or the Internet, you may change your vote or revoke your proxy with a later telephone or Internet proxy, as the case may be. Attendance at the Annual Meeting will not have the effect of revoking a proxy unless you give written notice of revocation to the Secretary before the proxy is exercised or you vote by written ballot at the Annual Meeting.

| 8. | What is a broker non-vote and what is the impact of not voting? |

A broker “non-vote” occurs when a bank, broker, or nominee holding shares of common stock for a beneficial owner does not vote on one or more proposals because the nominee does not have discretionary voting power on that matter, which is also referred to as holding shares in street name. Your bank or broker does not have discretion to vote uninstructed shares on the proposals in this Proxy Statement, except for Proposal No.4 to ratify the appointment of our independent registered public accounting firm. As a result, if you hold your shares in street name, it is critical that you provide instructions to your bank or broker, if you want your vote to count in the election of directors and the advisory vote related to executive compensation. If you are a stockholder of record and you do not cast your vote, no votes will be cast on your behalf on any of the items of business at the Annual Meeting.

| 9. | What constitutes a quorum? |

A quorum is the minimum number of stockholders necessary to conduct the Annual Meeting. The presence at the Annual Meeting, in person or by proxy, of the holders of a majority of common stock outstanding on the Record Date will constitute a quorum. As of the close of business on the Record Date, there were 3,099,270 shares of our common stock outstanding. Votes “for” and “against,” “abstentions,” and broker “non-votes” will all be counted as present to determine whether a quorum has been established.

| 10. | Is cumulative voting permitted for the election of directors? |

No, each stockholder may vote only the number of shares he or she owns for a single director candidate.

| 4 |

| 11. | What is the vote required for a proposal to pass? |

Proposal No. 1—Election of Directors: The affirmative vote of a plurality of the votes cast of the shares of common stock present or represented and entitled to vote at the Annual Meeting, in person or by proxy, is required for the election of a nominee. Thus, assuming a quorum is present at the Annual Meeting, the nominee who receives the most affirmative votes will be elected as Class II director. Abstentions and broker “non-votes” will not have any effect on the voting outcome with respect to the election of directors.

Proposal No. 2—Say-on-Pay: Because this proposal asks for a non-binding, advisory vote, there is no required vote that would constitute approval. We value the opinions expressed by our stockholders in this advisory vote, and our Compensation Committee, which is responsible for overseeing and administering our executive compensation programs, will consider the outcome of the vote when designing our compensation programs and making future compensation decisions for our Named Executive Officers. Abstentions and broker “non-votes,” if any, will not have any impact on this advisory vote.

Proposal No. 3—Frequency of Say-on-Pay: Stockholders may cast a vote for “1 Year,” “2 Years,” “3 Years” or “ABSTAIN” from voting on this proposal. Because this proposal asks for a non-binding, advisory vote, there is no required vote that would constitute approval. We value the opinions expressed by our stockholders in this advisory vote, and our Board values the opinions expressed by our stockholders and will take into account the outcome of this vote when considering the frequency of future advisory say-on-pay votes. Abstentions and broker “non-votes,” if any, will not have any impact on this advisory vote.

Proposal No. 4—Ratification of Independent Registered Public Accounting Firm: The affirmative vote of a majority of the votes present at the Annual Meeting and entitled to vote, in person or by proxy, is required to ratify our selection of Frazier & Deeter, LLC as our independent registered public accounting firm for the fiscal year ending March 31, 2023. Abstentions will have the practical effect of a vote to not ratify our selection. Because we believe that Proposal No. 4 is a routine proposal on which a broker or other nominee is generally empowered to vote, broker “non-votes” likely will not result from this proposal. If you are a beneficial owner holding shares through a broker, bank, or other nominee and you do not instruct your broker or bank, your broker or bank may cast a vote on your behalf for this proposal.

| 5 |

Proposal No. 1 – Election of Director

Upon the recommendation of the Nominating and Corporate Governance Committee, our Board of Directors has nominated Dr. Jay Birnbaum for election at the 2022 Annual Meeting. The Board believes that the nominee’s knowledge, skills, and abilities would positively contribute to the function of the Board as a whole. Accordingly, your proxy holder will vote your shares FOR the election of the Board’s nominee named below unless you instruct otherwise.

At our 2008 Annual Meeting of Stockholders, our stockholders approved an amendment to our Restated Certificate of Incorporation, as amended, which provided that directors are classified into three classes, as nearly equal in number as possible, with each class serving for a staggered three-year term. Our Board currently consists of four directors:

| Name | Position with the Company | Director Since |

Term Expires | |

| Class I | ||||

| Philippe Weigerstorfer | Class I Director | 2018 | 2024 | |

Amy Trombly (1) |

Class I Director | 2022 | 2024 | |

| Class II | ||||

| Jay Birnbaum | Class II Director | 2007 | 2022 | |

| Class III | ||||

| Jerry McLaughlin | Class III Director | 2013 | 2023 |

(1) Amy Trombly, our Chief Executive Officer, was appointed to our Board of Directors on July 22, 2022.

With regard to the election of directors, votes may be cast “FOR” or “WITHHOLD.” Provided that a quorum is present, the affirmative vote by the holders of a plurality of the shares of common stock present and voting at the Annual Meeting is required to elect the nominee for director.

What am I voting on and what is the required vote?

Stockholders are being asked to elect one Class II Director nominee for a three-year term. The nominee is currently a director of Sonoma. Biographical and related information about all directors, including Dr. Birnbaum, who is the nominee for this year’s election, is set forth below. Although the Board expects that the nominee will be available to serve as a director, if he should be unwilling or unable to serve, the Board may decrease the size of the Board or may designate substitute nominees and the proxies will be voted on such substitute nominee. The affirmative vote of a plurality of the votes cast of the shares of common stock present or represented and entitled to vote at the Annual Meeting, in person or by proxy, is required for the election of a nominee.

|

Your Board of Directors recommends a vote FOR the election of the director nominee, Jay Birnbaum. |

| 6 |

Director Biographies and Qualifications

Below are the biographies of our directors and certain information regarding each director’s experience, attributes, skills and/or qualifications that led to the conclusion that the director should be serving as a director of Sonoma.

|

Jay Birnbaum

Current Position:

Director Since:

Age:

Committee Membership: |

Independent Director

April 2007

77

Audit, Compensation, Nominating and Corporate Governance |

Dr. Birnbaum is a pharmacologist and since 1999, has been a consultant to pharmaceutical companies in his area of expertise. He previously served as Vice President of Global Project Management at Novartis/Sandoz Pharmaceuticals Corporation, where he was also responsible for the strategic planning and development of the company’s dermatology portfolio. Dr. Birnbaum was a co-founder and former Chief Medical Officer of Kythera Biopharmaceuticals (which was acquired by Allergan), and a member of the board of directors of Excaliard Pharmaceuticals (which was acquired by Pfizer). Dr. Birnbaum is a co-founder and member of the Board of Directors of Hallux, Inc., a co-founder and Executive Vice President of Lipido Pharmaceuticals, Inc., and serves on the scientific advisory board of several companies.

Education:

| l | B.S. in Biology from Trinity College in Connecticut | |

| l | Ph.D. in Pharmacology from the University of Wisconsin |

Special Knowledge, Skills, and Abilities:

|

Extensive Knowledge of the Company’s Business Dr. Birnbaum has served on our Board for 15 years, and has gained a deep understanding of the workings and direction of the Company. He has successfully guided the Company through leadership and strategy transitions evidencing his commitment to the Company and his willingness to adapt to ensure its continued success. |

|

Pharmaceutical Background Dr. Birnbaum has extensive experience in pharmacology, having served as a practicing pharmacologist and consultant for over a decade. Dr. Birnbaum also was the co-founder and former Chief Medical Officer of Kythera Biopharmaceuticals (which was acquired by Allergan), and a member of the board of directors of Excaliard Pharmaceuticals (which was acquired by Pfizer). Currently, co-founder and member of the Board of Directors of Hallux, Inc., a co-founder and Executive Vice President of Lipido Pharmaceuticals, Inc., and serves on the scientific advisory board of several companies. |

|

Leadership Dr. Birnbaum has extensive leadership experience in the pharmaceutical industry. He has co-founded multiple biopharmaceutical companies, served on the board of directors for companies in the industry, as well as serving on several scientific advisory boards in the life sciences field. |

| 7 |

|

Jerry McLaughlin

Current Position:

Director Since:

Age:

Committee Membership: |

Lead Independent Director

March 2013

74

Audit (Chair), Compensation (Chair) |

Mr. McLaughlin served as Interim Chief Executive Officer of Applied BioCode, Inc. from November 2011 to April 2013. In April 2011, he also founded, and until April 2016, served as Chairman of the Board and Chief Executive Officer, of DataStream Medical Imaging Systems, Inc., a start-up to develop diagnostic imaging software applications that work in conjunction with existing digital radiology platforms. He previously served as President of DataFlow Information Systems, from July 2007 to December 2011, and President and Chief Executive Officer of CompuMed, Inc. from May 2002 to June 2007.

| Education: |

|

l | B.S. in Pharmacy from State University of New York at Buffalo |

Special Knowledge, Skills, and Abilities:

|

Sales and Marketing Mr. McLaughlin possesses significant sales and marketing experience, having worked with several companies in the scientific industry. |

|

Healthcare Industry Mr. McLaughlin has a depth of experience operating and serving as senior management in the scientific, software, and medical device industry, including having positions of increasing authority at DataStream Medical Imaging Systems; DataFlow Information Systems and CompuMed, Inc. |

|

Leadership Mr. McLaughlin has extensive leadership experience both as a director and executive at multiple companies. His range of experiences offers versatility and skill in many areas of leadership. Mr. McLaughlin has served as our Lead Independent Director since 2014. |

| 8 |

|

Philippe Weigerstorfer

Current Position:

Director Since:

Age:

Committee Memberships: |

Independent Director

September 2018

62

Audit, Nominating and Corporate Governance (Chair) |

Mr. Weigerstorfer has served on our Board of Directors since September 2018. He is the owner and managing director of Weigerstorfer New Venture LLC (GmbH) Switzerland. Since January 2020, he serves as the chairman of the board of Onycho Pharma Pte. Ltd., Singapore. From 2011 until the end of 2017, Mr. Weigerstorfer was the managing director of Vifor Pharma Asia Pacific Pte Ltd, a company of the Vifor Pharma Group, which specializes in treatment and prevention of iron deficiencies and also contains an infectious diseases/OTX product portfolio. As managing director, Mr. Weigerstorfer was responsible for managing the activities of Vifor Asia Pacific in Singapore and overseeing the Asia Pacific region. He worked at Vifor Pharma since 2008. From 2000 to 2016, he worked at Galencia Ltd. where he rose to the position of Special Advisor to the executive Chairman of Galencia, helping insure corporate growth through acquisition of pharmaceutical companies, licenses, and projects. From 1996 to 1999 he worked at Novartis Pharma Ltd. where he headed the corporate marketing for the “dermatology and others” area and helped Novartis to become one of the leading dermatology company in the world. Previous to that, Mr. Weigerstorfer worked with Sandoz Pharma AG in many different roles including as head of the dermatology and cardiovascular business unit. He also taught at business school.

| Education: |

| l | Degree in Business Administration and Economics from University Basel | |

| l | Minor in Law from University Basel |

Special Knowledge, Skills, and Abilities:

|

Pharmaceutical Background Mr. Weigerstorfer has worked in the pharmaceutical industry for most of his career and has extensive experience working strategically in the field both internationally and during the development of clinical-stage products. |

|

International Business Mr. Weigerstorfer has extensive experience in global markets, having spent much of his career working in Switzerland, Canada, and Singapore. He has worked for foreign-based companies, including one of the leading dermatology companies in the world. |

|

Sales and Marketing Mr. Weigerstorfer possesses significant sales and marketing experience, having worked with several companies in the pharmaceutical industry and overseeing much of their sales and business strategy. |

| 9 |

Amy Trombly, age 55, was appointed to our Board of Directors on July 22, 2022. She has been our Chief Executive Officer since September 27, 2019. For information regarding her experience, attributes, skills and/or qualifications, please refer to “Executive Officers’ Biographies and Qualifications” below.

Our Board of Directors held 3 meetings in fiscal year 2022 and, in addition, took action from time to time by unanimous written consent. In fiscal year 2022, no incumbent director attended fewer than 75% of the total number of Board meetings (held during the period for which such director served) and all directors attended all of the meetings. The independent directors met regularly in executive sessions without the participation of the Chief Executive Officer or the other members of management. We do not have a policy that requires the attendance of directors at our Annual Meetings of Stockholders. No director attended the 2021 Annual Meeting of Stockholders.

Committees of the Board of Directors

Our Board of Directors has appointed an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee. The Board of Directors has determined that each director who serves on these committees is “independent,” as that term is defined by the Nasdaq Listing Rules and rules of the SEC. The Board of Directors has adopted written charters for its Audit Committee, its Compensation Committee, and its Nominating and Corporate Governance Committee. Copies of these charters are available on our website at http://ir.sonomapharma.com/governance-docs. In addition to the number of meetings referenced below, the Committees also took actions by unanimous written consent.

Information about each of our committees is stated below.

| Name of Committee Member | Audit | Compensation | Nominating and Corporate Governance |

| Jerry McLaughlin | C | C | |

| Philippe Weigerstorfer | M | C | |

| Jay Birnbaum | M | M | M |

C = Committee Chair

M = Member

| 10 |

Audit Committee

|

Jerry McLaughlin Committee Chair |

Other Committee Members: Jay Birnbaum, and Philippe Weigerstorfer Meetings Held in Fiscal Year 2022: 5

|

Each of the members on the Audit Committee meets the independence standards for independent directors under the Nasdaq Listing Rules. Mr. McLaughlin meets the standard of “audit committee financial expert,” as defined in Item 407(d)(5)(ii) of Regulation S-K. The Audit Committee has a written charter.

Primary Function:

To assist the Board of Directors in fulfilling its oversight responsibilities related to our financial statements, system of internal control over financial reporting, auditing, accounting and financial reporting processes. Other specific duties and responsibilities of the Audit Committee are to appoint, compensate, evaluate and, when appropriate, replace our independent registered public accounting firm; review and pre-approve audit and permissible non-audit services; review the scope of the annual audit; monitor the independent registered public accounting firm’s relationship with us; and meet with the independent registered public accounting firm and management to discuss and review our financial statements, internal control over financial reporting, and auditing, accounting and financial reporting processes.

Compensation Committee

|

Jerry McLaughlin Committee Chair |

Other Committee Members: Jay Birnbaum Meetings Held in Fiscal Year 2022: 3

|

Primary Function:

To assist the Board of Directors in meeting its responsibilities in regards to oversight and determination of executive compensation and to review and make recommendations with respect to major compensation plans, policies, and programs of our Company. Other specific duties and responsibilities of the Compensation Committee are to review and approve goals and objectives relevant to the recommendations for approval by the independent members of the Board of Directors regarding compensation of our Chief Executive Officer and other executive officers, establish and approve compensation levels for our Chief Executive Officer and other executive officers, and to administer our stock plans and other equity-based compensation plans.

Nominating and Corporate Governance Committee

|

Philippe Weigerstorfer Committee Chair |

Other Committee Members: Jay Birnbaum Meetings Held in Fiscal Year 2022: 1

|

Primary Function:

To identify

qualified individuals to become members of the Board of Directors, determine the composition of the Board and its Committees, and to monitor

a process to assess Board effectiveness. Other specific duties and responsibilities of the Nominating and Corporate Governance Committee

are to recommend nominees to fill vacancies on the Board of Directors, review and make recommendations to the Board of Directors with

respect to director candidates proposed by stockholders, and review, on an annual basis, the functioning and effectiveness of the Board

and its Committees.

| 11 |

Director Independence and Related Person Transactions

Independent Directors

Standard for Independence—We determine independence using the definitions set forth in the Nasdaq Listing Rules and the rules under the Securities Exchange Act of 1934. These definitions define independence based on whether the director or a family member of the director has been employed by the Company in the past three years, how much compensation the director or family member of a director received from the Company, how much stock the director or a family member of the director owns in the Company, and whether the director or a family member of the director is associated with the Company’s independent auditor.

The Board has determined that the following directors are independent:

| · | Jay Birnbaum; |

| · | Jerry McLaughlin; and |

| · | Philippe Weigerstorfer. |

Related Person Transactions

It is our policy that all employees, officers and directors must avoid any activity that is, or has the appearance of, conflicting with the interests of our Company. This policy is included in our Code of Business Conduct, and our Board formally adopted a Related Party Transaction Policy and Procedures in July 2007 for the approval of interested transactions with persons who are Board members or nominees, executive officers, holders of 5% of our common stock, or family members of any of the foregoing. The Related Party Transaction Policy and Procedures are administered by our Audit Committee. We conduct a review of all related party transactions for potential conflict of interest situations on an ongoing basis and all such transactions relating to executive officers and directors must be approved by the Audit Committee.

Effective September 25, 2019, Ms. Trombly was appointed as our Chief Executive Officer. On July 22, 2022, Ms. Trombly was appointed to serve as a member of the Board of Directors. Ms. Trombly is the owner of Trombly Business Law, PC which has been retained by the Company to advise on certain corporate and securities law matters. During the years ending March 31, 2022 and 2021, we received $170,000 and $215,000 in legal services from Trombly Business Law, PC. On December 30, 2019, our Audit Committee approved a waiver to the conflicts of interest provision of our Code of Business Conduct in relation to the employment of our Chief Executive Officer, Ms. Amy Trombly, and her ownership and interest in Trombly Business Law, PC. The Audit Committee authorized the Corporation to continue to use Trombly Business Law, PC for certain legal services. Currently, the Audit Committee approves bills on a monthly basis. Effective July 22, 2022, we entered into an amended and restated employment agreement with Ms. Trombly. Under the amended and restated agreement, Ms. Trombly will devote substantially all of her time, energy and skill to the performance of her duties as Chief Executive Officer for the Company. We also agreed that Sonoma would no longer receive services from Ms. Trombly's firm and there would be no future related party transactions from this relationship.

Arrangements or Understandings between our Executive Officers or Directors and Others

There are no arrangements or understandings between our executive officers or directors and any other person pursuant to which he was or is to be selected as a director or officer.

Information about Corporate Governance

On October 26, 2017, our Board adopted corporate governance standards to provide a structure within which directors and management effectively pursue the Company’s objectives for the benefit of the Company’s stockholders. These standards set out the principal functions of the Board, its structure and composition, operations, interaction with third parties and committees as well as management’s responsibilities. A copy of the corporate governance guidelines is available on our website at http://ir.sonomapharma.com/governance-docs.

| 12 |

Board Leadership Structure

Since February 1, 2013, we have had separate individuals serving as Chairman of the Board of Directors and our Principal Executive Officer. Ms. Trombly was appointed as our Chief Executive Officer on September 27, 2019. The Board appointed Mr. Jerry McLaughlin to serve as the Lead Independent Director effective March 26, 2014. As Chief Executive Officer, Ms. Trombly manages the day-to-day affairs of the Company and, as Lead Independent Director, Mr. McLaughlin leads the Board meetings and leads the Board in overseeing management. On July 22, 2022, Ms. Trombly was appointed to serve as a member of the Board of Directors.

The Board believes that this structure is currently serving our Company well, and intends to maintain it where appropriate and practicable in the future. We have had varying board leadership models over our history, at times separating the positions of Chairman and Chief Executive Officer and at times combining the two. The Board believes that the right structure should be informed by the needs and circumstances of our Company, the Board, and our stockholders, and we believe having an independent director lead the Board best serves these interests.

Board Diversity

Pursuant to Nasdaq Listing Rule 5606, as of July 22, 2022, our directors self-identify as follows:

| Female | Male | |

| Total Number of Directors | 1 | 3 |

| Part I: Gender Identity | ||

| Directors | 1 | 3 |

| Part II: Demographic Background | ||

| White | 1 | 3 |

Risk Oversight Management

The Board of Directors takes an active role, as a whole, and at the committee level, in overseeing management regarding our Company’s risks. Our management keeps the Board of Directors apprised of significant risks facing our Company and the approach being taken to understand, manage, and mitigate such risks. Specifically, strategic risks are overseen by the full Board of Directors; financial risks are overseen by the Audit Committee; risks relating to compensation plans and arrangements are overseen by the Compensation Committee; risks associated with director independence and potential conflicts of interest are overseen by the Audit Committee or the full Board of Directors. The Board has created in the past and plans to, when necessary in the future, create a Special Transaction Committee to review potential or actual conflicts of interest. Additional review or reporting on enterprise risks is conducted as needed, or as requested by the full Board of Directors, or the appropriate committee.

Director Nominations

The Board of Directors nominates directors for election at each Annual Meeting of Stockholders and appoints new directors to fill vacancies when they arise. The Nominating and Corporate Governance Committee has the responsibility to identify, evaluate, recruit, and recommend qualified candidates to the Board of Directors for nomination or election.

One of the Board of Directors’ objectives in evaluating director nominations is to ensure that its membership is composed of experienced and dedicated individuals with a diversity of backgrounds, perspectives, and skills. The Nominating and Corporate Governance Committee will select nominees for director based on their character, judgment, diversity of experience, business acumen, and ability to act on behalf of all stockholders. We do not have a formal diversity policy. However, the Nominating and Corporate Governance Committee endeavors to have a Board representing diverse viewpoints as well as diverse expertise at policy-making levels in many areas, including business, accounting and finance, healthcare, manufacturing, marketing and sales, education, legal, government affairs, regulatory affairs, research and development, business development, international aspects of our business, technology, and in other areas that are relevant to our activities.

| 13 |

The Nominating and Corporate Governance Committee believes that nominees for director should have experience, such as those mentioned above, that may be useful to Sonoma and the Board of Directors, high personal and professional ethics, and the willingness and ability to devote sufficient time to carry out effectively their duties as directors. The Nominating and Corporate Governance Committee believes it appropriate for at least one, and, preferably, multiple, members of the Board of Directors to meet the criteria for an “audit committee financial expert” as defined by rules of the SEC, and for a majority of the members of the Board of Directors to meet the definition of “independent director” as defined by the Nasdaq Listing Rules. The Nominating and Corporate Governance Committee also believes it appropriate for key members of our management to participate as members of the Board of Directors. Prior to each Annual Meeting of Stockholders, the Nominating and Corporate Governance Committee identifies nominees first by evaluating the current directors whose term will expire at the Annual Meeting and who are willing to continue in service. These candidates are evaluated based on the criteria described above, including as demonstrated by the candidate’s prior service as a director, and the needs of the Board of Directors with respect to the particular talents and experience of its directors. In the event that a director does not wish to continue in service, the Nominating and Corporate Governance Committee determines not to re-nominate the director, or if a vacancy is created on the Board of Directors as a result of a resignation, an increase in the size of the Board or other event, the Committee will consider various candidates for Board membership, including those suggested by the Committee members, by other Board members, by any executive search firm engaged by the Committee or by stockholders. The Committee recommended the nominees for election included in this Proxy Statement. A stockholder who wishes to suggest a prospective nominee for the Board of Directors should notify Sonoma’s Secretary, or any member of the Committee in writing, and include any supporting material the stockholder considers appropriate. In addition, our Bylaws contain provisions addressing the process by which a stockholder may nominate an individual to stand for election to the Board of Directors at our Annual Meeting of Stockholders. In order to nominate a candidate for director, a stockholder must give timely notice in writing to Sonoma’s Secretary and otherwise comply with the provisions of our Bylaws. To be timely, our Bylaws provide that we must have received the stockholder’s notice not earlier than 90 days nor more than 120 days in advance of the one-year anniversary of the date the Proxy Statement was released to the stockholders in connection with the previous year’s Annual Meeting of Stockholders; however, if we have not held an Annual Meeting in the previous year or the date of the Annual Meeting is changed by more than 30 days from the date contemplated at the time of the mailing of the prior year’s Proxy Statement, we must have received the stockholder’s notice not later than the close of business on the later of the 90th day prior to the Annual Meeting or the seventh day following the first public announcement of the Annual Meeting date. Information required by the Bylaws to be in the notice includes the name and contact information for the candidate, the name and contact information of the person making the nomination, and other information about the nominee that must be disclosed in proxy solicitations under Section 14 of the Securities Exchange Act of 1934 and the related rules and regulations under that Section.

Stockholder nominations must be made in accordance with the procedures outlined in, and must include the information required by, our Bylaws and must be addressed to: Secretary, Sonoma Pharmaceuticals, Inc., 645 Molly Lane, Suite 150, Woodstock, Georgia 30189. You can obtain a copy of our Bylaws by writing to the Secretary at this address.

Stockholder Communications with the Board of Directors

If you wish to communicate with the Board of Directors, you may send your communication in writing to: Secretary, Sonoma Pharmaceuticals, Inc., 645 Molly Lane, Woodstock, Georgia 30189. Please include your name and address in the written communication and indicate whether you are a stockholder of Sonoma. The Secretary will review any communication received from a stockholder, and all material communications from stockholders will be forwarded to the appropriate director or directors or Committee of the Board of Directors based on the subject matter.

The following table sets forth the amounts and the value of other compensation earned or paid to our directors for their service in fiscal year 2022.

| Name of Director | Fees Earned or Paid in Cash ($) (1) | Option Awards ($) (2) (3) | Total ($) |

| Sharon Barbari (4) | 29,000 | -- | 29,000 |

| Jay Birnbaum | 48,000 | 121,000 | 169,000 |

| Jerry McLaughlin | 64,000 | 121,000 | 185,000 |

| Philippe Weigerstorfer | 51,000 | 121,000 | 172,000 |

| (1) | Includes the cash retainer fees earned by each non-employee director in fiscal year 2022. | |

| (2) | Represents the aggregate grant date fair value of option awards granted in the covered fiscal year as computed in accordance with FASB ASC Topic 718. The fair value of each option award is estimated for the covered fiscal year on the date of grant using the Black-Scholes option valuation model. A discussion of the assumptions used in calculating the amounts in this column may be found in Note 13 to our audited consolidated financial statements for the applicable fiscal year. The amounts in this column do not represent the actual amounts paid to or realized by our directors during the covered fiscal year. |

| 14 |

| (3) | Each director was awarded 30,000 options on January 14, 2022 as part of the annual grant. The options have an exercise price of $4.60 per share and vest in three equal tranches on the six-month, 18-month and 30-month anniversary of the grant date, or upon change of control. | |

| (4) | Ms. Barbari retired from our Board effective September 21, 2021. |

As of March 31, 2022, our independent directors had the following aggregate numbers of granted and outstanding options, respectively: Mr. Birnbaum – 32,904, Mr. Weigerstorfer – 30,000; and Mr. McLaughlin – 33,252.

Narrative to Director Compensation Table

Non-Employee Director Compensation Plan

Pursuant to our non-employee director compensation plan, as amended on January 12, 2022, during the year ended March 31, 2022 each non-employee director is entitled to the following annual retainers:

| · Board Member | $32,500 |

| · Lead Independent Director | $15,000 |

| · Chair of the Audit Committee | $10,000 |

| · Chair of the Compensation Committee | $7,500 |

| · Chair of the Nominating and Corporate Governance Committee | $7,500 |

| · Audit Committee Member (other than Chair) | $7,500 |

| · Compensation Committee Member (other than Chair) | $7,500 |

| · Nominating and Corporate Governance Committee Member (other than the Chair) | $7,500 |

All Audit Committee retainers must be paid in cash. All other retainers may be paid in (i) cash, (ii) options, or (iii) as a stock grant, at the election of each director. We also reimburse our non-employee directors for reasonable expenses in connection with attendance at Board and committee meetings.

In addition to the annual retainers, non-employee directors are also eligible to receive an annual grant of 30,000 options to purchase up to 30,000 shares of common stock. The annual grant is made in or around January of each year together with the employee annual grant. No annual grant shall be granted to any non-employee director in the same calendar year that such person received his or her initial grant.

Each newly elected or appointed non-employee director will receive our initial grant of 2,500 shares of common stock upon his or her election to the Board of Directors. The initial grant will vest in three equal installments over a period of three years, on the first, second, and third anniversary of the grant.

In the interest of good corporate governance and to further align the interests of members of the Board of Directors with the Company’s stockholders, the Nominating and Corporate Governance Committee of the Board of Directors has adopted stock ownership guidelines for directors. Under these guidelines, if a director exercises a stock option, it is expected that such director would, from such date of option exercise, maintain ownership of at least a number of shares equal to twenty percent of the net value of the shares acquired (after deducting the exercise price and taxes). In the case of shares acquired upon the exercise of a stock option, each director is expected to hold such shares for nine months after termination of his or her service on the Board of Directors.

| 15 |

Executive Officers’ Biographies and Qualifications

Below are the biographies of our executive officers and certain information regarding each officer’s experience, attributes, skills and/or qualifications that led to the conclusion that the officer should be serving as an officer of Sonoma are stated below.

Amy Trombly, Chief Executive Officer

Ms. Trombly, age 55, has been our Chief Executive Officer since September 27, 2019. She has counseled public companies for two decades in corporate and securities law and mergers and acquisitions. She has owned and managed Trombly Business Law, PC since 2002. In her earlier career, Ms. Trombly was a Vice President at State Street Bank and Special Counsel at the U.S. Securities and Exchange Commission.

| Education: |

| · | BS in Finance and Accounting from Suffolk University | |

| · | J.D. from Suffolk University Law School | |

| · | Member of the bar in Massachusetts and Colorado |

Special Knowledge, Skills, and Abilities:

|

Leadership Ms. Trombly is the owner of Trombly Business Law, P.C. for over 19 years. Prior to that, she served in senior positions at the U.S. Securities and Exchange Commission, State Street and Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C. |

|

Extensive Knowledge of the Company’s Business Ms. Trombly has counseled the Company for over 10 years and gained extensive knowledge of our business and operations. |

|

Legal Expertise Ms. Trombly is able to consistently utilize her legal training and experience when making decisions in the best interest of the Company. |

Jerry Dvonch, Chief Financial Officer

Mr. Dvonch, age 54, was appointed as our Chief Financial officer on September 8, 2020. From March 2017 to August 2020, he was the controller and Senior Vice President of Finance and Accounting of the SpineCenter Atlanta. From March 2016 to April 2016, he was a consultant controller for DS Healthcare Group, Inc. Prior to that he was the director for external reporting and director of finance of NeoGenomics Laboratories from July 2005 to July 2015. He has over 10 years of experience with SEC reporting.

| Education: |

| · | Bachelor of Business Administration in Accounting from Niagara University | |

| · | Master of Business Administration in Finance from University of Rochester | |

| · | Certified Public Accountant in New York |

| 16 |

Special Knowledge, Skills, and Abilities:

|

Leadership Mr. Dvonch has extensive knowledge leading companies for over 15 years in various industries. He has held financial leadership positions at several healthcare companies. |

|

Business Operations Mr. Dvonch has over 20 years of experience leading companies in various financial leadership positions. |

|

Financial Expertise Mr. Dvonch is a licensed Certified Public Accountant and holds a Master’s Degree in Business Administration. His variety of financial experience provides depth and knowledge on a range of financial matters. |

Bruce Thornton, Chief Operating Officer, Corporate Secretary

Mr. Thornton, age 58, has served as our Chief Operating Officer since April 2020 and serves as our Corporate Secretary. Mr. Thornton served as our Executive Vice President for International Operations and Sales and General Manager for U.S. operations from March 2004 to April 2020. He served as Vice President of Operations for Jomed (formerly EndoSonic Corp.) from January 1999 to September 2003, and as Vice President of Manufacturing for Volcano Therapeutics, an international medical device company, following its acquisition of Jomed, until March 2004.

| Education: |

| · | BS in Aeronautical Science from Embry-Riddle Aeronautical University | |

| · | MBA from National University |

Special Knowledge, Skills, and Abilities:

|

Business Development Mr. Thornton has been working for our Company for almost 20 years, including in leadership positions and operations. He has an extensive knowledge of our operations, the market for our products, and our vision and goals for the future. |

|

Business Operations Mr. Thornton has extensive experience managing operations. In addition to serving as our Company’s EVP of International Operations and Manager of Operations for a decade, Mr. Thornton has managed major business operations for other companies in the industry for over 25 years. |

|

Leadership Mr. Thornton has served both as an executive and high-level manager at our Company for over a decade and has served in similar roles at other companies in the medical device sector. He has overseen our recent Petaluma facility closure and taken on leadership roles in our Company during the recent management transitions. He also served in the U.S. Army. |

| 17 |

This Proxy Statement contains information about the compensation paid to our Named Executive Officers, as defined by Item 402(m)(2) of Regulation S-K, during our fiscal year ended March 31, 2022, or fiscal year 2022. For fiscal year 2022, in accordance with the rules and regulations of the Securities and Exchange Commission for smaller reporting companies, we determined that the following officers were our Named Executive Officers:

| · | Amy Trombly, Chief Executive Officer; | |

| · | Jerry Dvonch, Chief Financial Officer; and | |

| · | Bruce Thornton, Chief Operating Officer. |

We qualify as a “smaller reporting company” under the rules promulgated by the Securities and Exchange Commission, and we have elected to comply with the disclosure requirements applicable to smaller reporting companies. Accordingly, this executive compensation summary is not intended to meet the “Compensation Discussion and Analysis” disclosure required of larger reporting companies.

Role of the Compensation Committee

The Compensation Committee’s primary functions are to assist the Board of Directors in meeting its responsibilities in regards to oversight and determination of executive compensation and to review and make recommendations with respect to our major compensation plans, policies, and programs. All compensation for our executive officers is determined by the Compensation Committee of our Board of Directors, which is composed only of independent directors. The Compensation Committee is charged with the responsibility of setting performance targets under the executive bonus plan, reviewing their performance, and establishing the total compensation of our executive officers on an annual basis. The Compensation Committee often discusses compensation matters as part of regularly scheduled Board and committee meetings. The Compensation Committee administers our 2016 Equity Incentive Plan and our 2021 Equity Incentive Plan, and is responsible for approving grants of equity awards under such plans. The Compensation Committee acts under the authority of a written charter, which is available on our website at http://ir.sonomapharma.com/governance.cfm.

Compensation Philosophy and Objectives

Our compensation philosophy for our Named Executive Officers is the same as for all our employees and is governed by the following principles. The Compensation Committee’s compensation objectives are to:

| · | attract and retain highly qualified individuals with a demonstrated record of achievement; | |

| · | reward past performance; | |

| · | provide appropriate incentives for future performance; and | |

| · | align the interests of our executive officers with the interests of the stockholders. |

To achieve this, we currently offer a competitive total compensation package consisting of: base salary; annual equity program; annual performance bonuses; and employee benefits, including group life insurance, health and dental care insurance; and certain other perquisites, including personal use of a Company automobile.

The Compensation Committee considers, with respect to each of our executive officers, the total compensation that may be awarded, including base salary, annual incentive compensation, long-term incentive compensation, and other benefits, such as discretionary cash bonuses, perquisites and other personal benefits available to each executive officer or that may be received by such executive officer under certain circumstances, including compensation payable upon termination of the executive officer under an employment agreement or severance agreement (if applicable) to determine final compensation. The Compensation Committee’s overall goal is to award compensation that is reasonable when all elements of potential compensation are considered. The Compensation Committee believes that cash compensation in the form of base salary and an annual incentive bonus provides the executives with short-term rewards for success in operations, and that long-term compensation through the award of stock options, and other equity awards aligns the objectives of management with those of our stockholders with respect to long-term performance and success.

| 18 |

The Compensation Committee also has historically focused on our financial and working capital condition when making compensation decisions and approving performance objectives. Because the Company has historically sought to preserve cash and currently does not operate at a profit, overall compensation traditionally has been weighted more heavily toward equity-based compensation. The Compensation Committee will continue to periodically reassess the appropriate weighting of cash and equity compensation in light of the Company’s expenditures in connection with commercial operations and its working capital needs.

Compensation Structure

Our executive compensation program consists of the following forms of compensation:

| · | Base Salary; | |

| · | Annual Equity Program; | |

| · | Annual Performance Bonus; and |

| · | Employee Benefit Program. |

1. Base Salary: The Compensation Committee believes it is important to provide adequate fixed compensation to our executive officers. The Compensation Committee believes base salaries should be at the appropriate cash compensation level that will allow us to attract and retain highly skilled executives. In determining appropriate base salary levels for a given executive officer, the Compensation Committee considers the following factors:

| · | individual performance of the executive, as well as overall performance, during the prior year; | |

| · | level of responsibility, including breadth, scope and complexity of the position; | |

| · | level of experience and expertise of the executive; | |

| · | internal review of the executive’s compensation relative to other executives to ensure internal equity; and | |

| · | executive officer compensation levels at other similar companies to ensure competitiveness. |

Salaries for executive officers are determined on an individual basis at the time of hire. Adjustments to base salary are considered annually in light of each executive officer’s individual performance, the Company’s performance, and compensation levels at peer companies in our industry, as well as changes in job responsibilities or promotion.

2. Annual Equity Program: As an additional component of our compensation program, the Compensation Committee may grant to our executive officers’ equity compensation in the form of stock options, restricted stock units, or shares of common stock with or without vesting schedule. The goal of the annual equity program is to align the interests of our executive officers with those of our stockholders, especially in the long-term. The stock options are designed to create an incentive for the executive officers to maximize stockholder value and to remain employed with the Company despite a competitive labor market.

Equity may be granted once annually to existing employees, including executive officers, and upon a new hire or promotion, and could be subject to vesting over time, qualified on the individual’s continued employment. The target date to issue equity is at the beginning of a new calendar year. The exercise price of the stock options will equal the closing price of our common stock published by Nasdaq on the date of the grant and the term of the options will be 10 years from the date of the grant. The Compensation Committee will review the annual equity program annually.

The Compensation Committee has sole discretion with respect to the tax treatment for equity awards and may decide, among others, to facilitate the sale of a sufficient number of the granted shares to cover taxes, or to require employees to be responsible for their own taxes.

3. Performance Bonus Plan: Our performance bonus plan is described in further detail below in the section entitled “Annual Performance Bonus Plan.”

| 19 |

4. Employee Benefit Program: Executive officers are eligible to participate in all of our available employee benefit plans, including medical, dental, vision, group life, disability, and tax-qualified retirement savings plans, such as 401(k), in each case on the same basis as other employees, subject to applicable law. We also provide vacation and other paid holidays to all employees, including executive officers, all of which the Compensation Committee believes to be comparable to those provided at peer companies. These benefit programs are designed to enable us to attract and retain workforce in a competitive marketplace. Health, welfare, and vacation benefits ensure that we have a productive and focused workforce through reliable and competitive health and other benefits.

We believe our approach to goal setting, setting of targets with payouts at multiple levels of performance, and evaluation of performance results assist in mitigating excessive risk-taking that could harm our value or reward poor judgment by our executive officers.

Summary Executive Compensation Table for the Fiscal Years Ended March 31, 2022 and 2021

The following table sets forth, for the fiscal years ended March 31, 2022 and 2021, all compensation paid or earned by (i) all individuals serving as our Principal Executive Officer; (ii) our two most highly compensated executive officers, other than our Principal Executive Officer, who were serving as executive officers at the end of our fiscal year ended March 31, 2022; and (iii) up to two individuals for whom disclosure would have been provided but for the fact that the individual was not serving as an executive officer. These executive officers are referred to herein as our “Named Executive Officers.”

| Name and Principal Position | Fiscal Year Ended March 31, | Salary ($) |

Bonus ($) |

Option Awards ($) (1) | All Other Compensation (2) ($) |

Total ($) |

|

Amy Trombly Chief Executive Officer |

2022 | 318,000 | 150,000 | 121,000 (3) | 54,000 | 643,000 |

| 2021 | 300,000 | 75,000 | 152,000 (4) | 53,000 | 580,000 | |

|

Jerry Dvonch Chief Financial Officer |

2022 | 200,000 | 58,000 | 121,000 (3) | 48,000 | 427,000 |

| 2021 | 111,000 | -- | 152,000 (4) | 24,000 | 287,000 | |

|

Bruce Thornton Chief Operating Officer |

2022 | 250,000 | 125,000 | 121,000 (3) | 58,000 | 554,000 |

| 2021 | 253,000 | 50,000 | 152,000 (4) | 62,000 | 517,000 |

| (1) | Represents the aggregate grant date fair value of stock or option awards granted in the covered fiscal year as computed in accordance with FASB ASC Topic 718. The fair value of each stock option award is estimated for the covered fiscal year on the date of grant using the Black-Scholes option valuation model. A discussion of the assumptions used in calculating the amounts in this column may be found in Note 13 to our audited consolidated financial statements for the applicable fiscal year. The amounts in this column do not represent the actual amounts paid to or realized by our Named Executive Officers during the fiscal years ended March 31, 2022 and 2021. |

| (2) | The following table provides the details for the amounts reported for FY 2022 and FY 2021 for each Named Executive Officer: |

| Name | Fiscal Year Ended March 31, | Personal Use of Company Car or Car Allowance ($) | Matching 401k Contribution ($) | Premium for Life, Health, Dental and Vision Insurance ($) | Professional license fees ($) |

| Amy Trombly | 2022 | -- | 12,000 | 40,000 | 2,000 |

| 2021 | -- | 11,000 | 42,000 | -- | |

| Jerry Dvonch | 2022 | -- | 8,000 | 40,000 | -- |

| 2021 | -- | 4,000 | 20,000 | -- | |

| Bruce Thornton | 2022 | 12,000 | 10,000 | 36,000 | -- |

| 2021 | 12,000 | 10,000 | 40,000 | -- |

| (3) | Annual grant of stock options with an exercise price of $4.60 per share, dated January 14, 2022 for services in fiscal year 2021: 30,000 options each for Amy Trombly, Bruce Thornton and Jerry Dvonch. The January 14, 2022 options vest one-third each on July 14, 2022, July 14, 2023, and July 14, 2024. |

| (4) | Annual grant of stock options with an exercise price of $8.03 per share, dated January 7, 2021 for services in fiscal year 2020: 27,777 options each for Amy Trombly, Bruce Thornton and Jerry Dvonch. The January 7, 2021 options vest one-third each on January 7, 2022, January 7, 2023 and January 7, 2024. |

| 20 |

Employment Agreements and Potential Payments upon Termination

Employment Agreement with Ms. Trombly

Effective on July 1, 2021, we entered into a new employment agreement with our Chief Executive Officer, Amy Trombly, after her prior agreement expired pursuant to its terms.

We agreed to pay Ms. Trombly a base salary of $325,000 per annum, and to provide our standard medical, dental and vacation benefits. Ms. Trombly will be eligible for a target bonus of up to 50% of her base salary per year upon the completion of certain agreed-upon goals based on the sole discretion of the Compensation Committee, and may earn 120% of the target bonus per year for exceeding goals, in the discretion of the Compensation Committee. She is also eligible for annual equity grants in the sole discretion of the Compensation Committee. As was the case with her old agreement, certain legal services not provided by Ms. Trombly will continue to be billed by Trombly Business Law, PC. The Board also agreed that during her time as Chief Executive Officer, Ms. Trombly may continue to represent other clients in her role as attorney.

The employment agreement provides Ms. Trombly with certain separation benefits in the event of termination without cause, for good reason or change of control, as such terms are defined in the employment agreement. In the event Ms. Trombly is terminated without cause, or for good reason or upon change of control, she is entitled to:

| · | a lump sum severance payment equal to six months of her base salary upon termination without cause or for good reason, and twelve months her base salary upon termination for change of control; | |

| · | upon termination without cause or for good reason a pro-rata bonus, upon determination by the Corporation’s Board of Directors or Compensation Committee, as appropriate, to be made in its sole discretion, and a target annual bonus amount of $162,500 upon termination upon change of control. The amount, form and payment schedule of such bonus shall be determined by the Compensation Committee. | |

| · | automatic vesting of all unvested time-based options and equity awards; | |

| · | vesting of performance-based equity compensation awards in accordance with the terms of the awards, if the performance goals are satisfied, such determination to be in the sole discretion of the Compensation Committee or the Board, as the case may be; and | |

| · | reimbursement for health care premiums under COBRA until the earliest of: (i) six or twelve months following the date of termination depending on the reason for termination; (ii) the date she is no longer eligible to receive COBRA continuation coverage; or (iii) until she becomes eligible for medical insurance coverage provided by another employer. |

Either party may terminate the employment agreement for any reason upon at least 60 days prior written notice. Upon termination for any reason, all vested equity awards will remain exercisable for 18 months following the termination. Receipt of the termination benefits described above is contingent on executing a general release of claims against our Company, resignation from any and all directorships and every other position held by the executive with our Company or any of our subsidiaries, and return of all Company property. In addition, Ms. Trombly will be required to comply with the confidentiality, non-compete, anti-solicitation and non-disparagement provisions of the employment agreement during the term of employment and for two years following termination.

Employment Agreement with Mr. Jerry Dvonch

Effective on July 1, 2021, we entered into an employment agreement with our Chief Financial Officer, Jerry Dvonch. We agreed to pay Mr. Dvonch a base salary of $200,000 per year, and to provide our standard medical, dental and vacation benefits. Mr. Dvonch will be eligible for a target bonus of up to 50% of his base salary per year upon the completion of certain agreed-upon goals based on the sole discretion of the Compensation Committee, and may earn 120% of the target bonus per year for exceeding goals, in the discretion of the Compensation Committee. He is also eligible for annual equity grants in the sole discretion of the Compensation Committee.

| 21 |

The employment agreement provides Mr. Dvonch with certain separation benefits in the event of termination without cause, for good reason or upon change of control, as such terms are defined in the employment agreement. In the event Mr. Dvonch is terminated without cause, for good reason or upon change of control, he is entitled to:

| · | a lump sum severance payment equal to six months of his base salary upon termination without cause or for good reason, and twelve months his base salary upon termination for change of control; | |

| · | upon termination without cause or for good reason a pro-rata bonus, upon determination by the Corporation’s Board of Directors or Compensation Committee, as appropriate, to be made in its sole discretion, and a target annual bonus amount of $100,000 upon termination upon change of control. The amount, form and payment schedule of such bonus shall be determined by the Compensation Committee; | |

| · | automatic vesting of all unvested time-based options and equity awards; | |

| · | vesting of performance-based equity compensation awards in accordance with the terms of the awards, if the performance goals are satisfied, such determination to be in the sole discretion of the Compensation Committee or the Board, as the case may be; and | |

| · | reimbursement for health care premiums under COBRA until the earliest of: (i) six or twelve months following the date of termination depending on the reason for termination; (ii) the date he is no longer eligible to receive COBRA continuation coverage; or (iii) until he becomes eligible for medical insurance coverage provided by another employer. |

Either party may terminate the employment agreement for any reason upon at least 60 days prior written notice. Upon termination for any reason, all vested equity awards will remain exercisable for 18 months following the termination. Receipt of the termination benefits described above is contingent on executing a general release of claims against our Company, resignation from any and all directorships and every other position held by the executive with our Company or any of our subsidiaries, and return of all Company property. In addition, Mr. Dvonch will be required to comply with the confidentiality, non-compete, anti-solicitation and non-disparagement provisions of the employment agreement during the term of employment and for two years following termination.

Employment Agreement with Mr. Bruce Thornton