Exhibit 99.1

Sonoma Pharmaceuticals, Inc. NASDAQ: SNOA January 2021

Legal Disclaimers INVESTOR PRESENTATION This communication is for informational purposes only. The information contained herein does not purport to be all - inclusive. T he data contained herein is derived from various internal and external sources. No representation is made as to the reasonableness of the assum pti ons made within or the accuracy or completeness of any information contained herein. Any data on past performance is no indication as to future performance. Sonoma Pharmaceuticals, Inc. (“Sonoma” or, the “Company”) assumes no obligation to update the information in thi s communication. This presentation is not an offer to buy or the solicitation of an offer to sell Sonoma securities. FORWARD - LOOKING STATEMENTS Except for historical information herein, matters set forth in this presentation are forward - looking within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including statements about the commercial and technology pro gress and future financial performance of Sonoma Pharmaceuticals, Inc. and its subsidiaries (the “Company”). These forward - looking statements are identified by the use of words such as “believe,” “achieve,” and “strive,” among othe rs. Forward - looking statements in this presentation are subject to certain risks and uncertainties inherent in the Company’s business that could cau se actual results to vary, including such risks that regulatory clinical and guideline developments may change, scientific data may not be suff ici ent to meet regulatory standards or receipt of required regulatory clearances or approvals, clinical results may not be replicated in act ual patient settings, the Company will not have sufficient capital to implement its business plan, invalidated or circumvented by its competitors, the ava ilable market for the Company’s products will not be as large as expected, the Company’s products will not be able to penetrate one or more tar get ed markets, revenues will not be sufficient to fund further development and clinical studies, as well as uncertainties relative to varyin g p roduct formulations and a multitude of diverse regulatory and marketing requirements in different countries and municipalities, and other risks d eta iled from time to time in the Company’s filings with the Securities and Exchange Commission. The Company disclaims any obligation to update the se forward - looking statements, except as required by law.

Legal Disclaimers NON - GAAP FINANCIAL MEASURES Non - GAAP income (loss) from operations minus non - cash expenses (EBITDAS) is a non - GAAP financial measure. The Company defines operating income (loss) minus non - cash expenses as GAAP reported operating income (loss) minus operating depreciation and amorti zation, and operating stock - based compensation. The Company uses this measure for the purpose of modifying the operating income (loss) t o reflect direct cash related transactions during the measurement period. TRADEMARKS AND INTELLECTUAL PROPERTY All trademarks, service marks, and trade names of the Company and its subsidiaries or affiliates used herein are trademarks, se rvice marks, or registered trademarks of the Company as noted herein. Any other product, company names, or logos mentioned herein are the tra dem arks and/or intellectual property of their respective owners.

About Sonoma Sonoma Pharmaceuticals is a global healthcare leader for developing and producing stabilized hypochlorous acid ( HOCl ) products for a wide range of applications, including wound care, animal health care, eye care, nasal care, oral care and dermatological conditions. The company’s products reduce infections, itch, pain, scarring and harmful inflammatory responses in a safe and effective manner. In - vitro and clinical studies of HOCl show it to have impressive antipruritic, antimicrobial, antiviral and anti - inflammatory properties. Sonoma’s stabilized HOCl immediately relieves itch and pain, kills pathogens and breaks down biofilm, does not sting or irritate skin and oxygenates the cells in the area treated assisting the body in its natural healing process. Sonoma also manufactures disinfectants that are distributed outside of the U.S. and in certain countries where it has received regulatory clearance to state the disinfectant kills the coronavirus causing COVID - 19. The company’s products are sold either directly or via partners in 54 countries worldwide and the company actively seeks new distribution partners.

Investor Highlights Diverse global healthcare leader • Focused on billion - dollar Rx and OTC wound care, dermatology, eye, oral and nasal care, disinfectant use and animal health markets • Over 20 years of experience • Robust international partner network; • Focused on expanding U.S. partner network Unique, patented and FDA - cleared, CE and ISO approved Microcyn® Technology • HOCl is known to be among the safest and most effective ways to relieve itch, inflammation, and burns while stimulating natural healing through increased oxygenation and eliminating persistent microorganisms and biofilms • Proven antipruritic, antimicrobial, antiviral and anti - inflammatory properties • Disinfectant Approved in Australia and Canada for use against COVID - 19 • Currently selling into 54 countries • Diverse application capability

Business Developments 2020 • Executed asset purchase agreement with MicroSafe Group, Dubai in February 2020 to extend partnership to the Middle East, Australia and Europe in wound care and surface disinfectants and animal health care • Received new CE marking for Microdacyn 60 ® Eye Care in April 2020 • Entered into expanded distribution agreement with Brill International S.L. Spain for the eye care product and new territories Germany, Italy, Spain, Portugal and UK in May 2020 • Approval by ARTG in Australia to use Nanocyn ® Disinfectant and Sanitizer against SARS - CoV - 2 in May 2020 and in Canada in September 2020 • Nanocyn ® Disinfectant and Sanitizer passed material compatibility testing for Boeing and Airbus in a joint effort by Sonoma and MicroSafe Group • Launched nasal and oral care products in Australia and New Zealand with partner Te Arai BioFarma • Executed exclusive OTC distribution agreement with Crown Laboratories, Inc. on December 7, 2020 • Launched Endocyn ®, a dental product, in December 2020 • Obtained FDA certification for Mexican facility

Current Research and Development • Dermodacyn ® Disinfecting solution study on viability of SARS - CoV - 2, see https://www.sciencedirect.com/science/article/pii/S019567012030339X • Endocyn ® study on cellular toxicity, see https://www.sciencedirect.com/science/article/abs/pii/S0099239917310439 • HOCl study evaluating virucidal activity in Vero E6 cells against SARS - CoV - 2, University of Barcelona, 11/27/2020 • Hypochlorous acid gel technology — Its impact on post - procedure treatment and scar prevention, see https://sonomapharma.com/wp - content/uploads/2020/08/Gold_et_al - 2017 - Journal_of_Cosmetic_Dermatology - 003.pdf • Topical stabilized hypochlorous acid: The future gold standard for wound care and scar management in dermatologic and plastic surgery procedures, see https://sonomapharma.com/wp - content/uploads/2020/08/Topical - Stabilized - HOCL - consensus - article - 2020.pdf • HOCl Article: Optimizing Wound Healing for Procedures – Apr 2018, see https://sonomapharma.com/wp - content/uploads/2018/11/Pracitcal - Derm - HOCl - article - 4 - 7 - 18 - wounds.pdf

Key Opportunities • Fully commercialize existing products via distribution partners or directly • 21 U.S. FDA clearances as medical devices for Section 510(k) • CEs for over 39 products • Expand OTC reach in U.S. in the dermatology, eye, oral and nasal care, disinfectants and wound care markets • Expand presence in the dental market • Continue to add international distribution partners; grow existing relationships • Robust product pipeline; continue to introduce new products worldwide • Expand disinfectant sales globally

Sonoma’s Microcyn Technology • Stable triple - action topical technology • A powerful anti - microbial - reduces microbial load, including destruction of biofilms • Anti - inflammatory agent – reduces itch and pain • Anti - pruritic activity • Tissue healing (increased blood/oxygen flow to wound) • Unparalleled safety – No drug - to - drug interaction or contraindications • Millions of patients treated worldwide without single report of serious adverse effect • 30+ human clinical trials with over 1,500 patients • No mutations or resistance • Overused antibiotics may cause deadly epidemics such as MRSA • Cost effective – Preventative – reduces hospital/physician visits – Medicare/hospital savings – faster healing reduces hospital stays

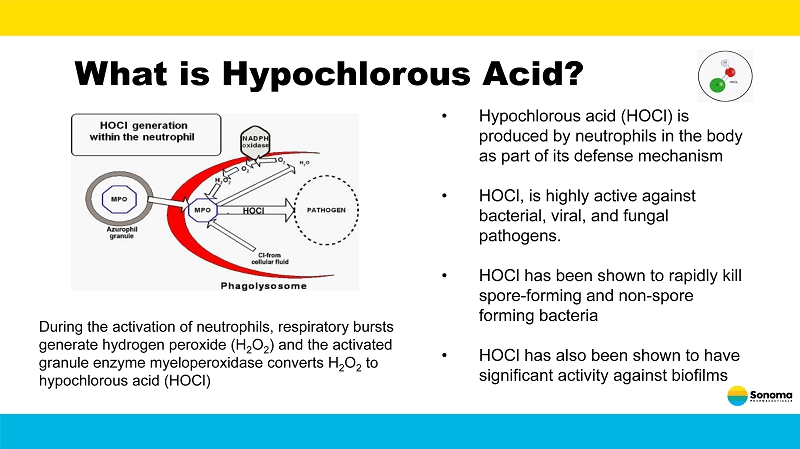

What is Hypochlorous Acid? During the activation of neutrophils, respiratory bursts generate hydrogen peroxide (H 2 O 2 ) and the activated granule enzyme myeloperoxidase converts H 2 O 2 to hypochlorous acid (HOCl) • Hypochlorous acid (HOCl) is produced by neutrophils in the body as part of its defense mechanism • HOCl, is highly active against bacterial, viral, and fungal pathogens. • HOCl has been shown to rapidly kill spore - forming and non - spore forming bacteria • HOCl has also been shown to have significant activity against biofilms

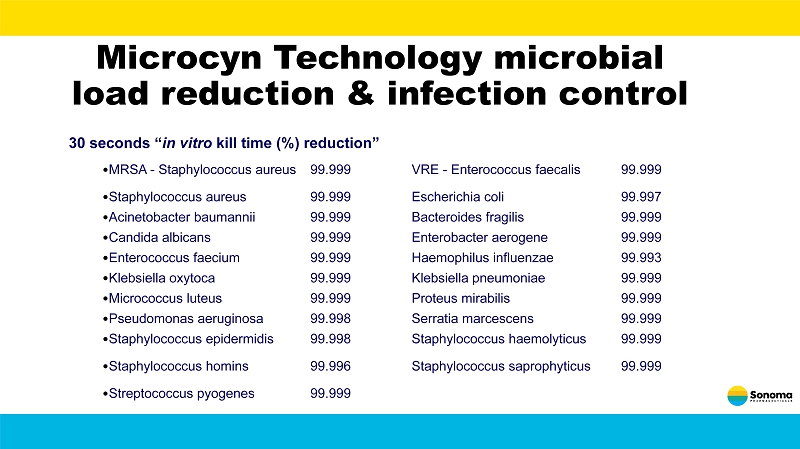

Microcyn Technology microbial load reduction & infection control 30 seconds “ in vitro kill time (%) reduction” • MRSA - Staphylococcus aureus 99.999 VRE - Enterococcus faecalis 99.999 • Staphylococcus aureus 99.999 Escherichia coli 99.997 • Acinetobacter baumannii 99.999 Bacteroides fragilis 99.999 • Candida albicans 99.999 Enterobacter aerogene 99.999 • Enterococcus faecium 99.999 Haemophilus influenzae 99.993 • Klebsiella oxytoca 99.999 Klebsiella pneumoniae 99.999 • Micrococcus luteus 99.999 Proteus mirabilis 99.999 • Pseudomonas aeruginosa 99.998 Serratia marcescens 99.999 • Staphylococcus epidermidis 99.998 Staphylococcus haemolyticus 99.999 • Staphylococcus homins 99.996 Staphylococcus saprophyticus 99.999 • Streptococcus pyogenes 99.999

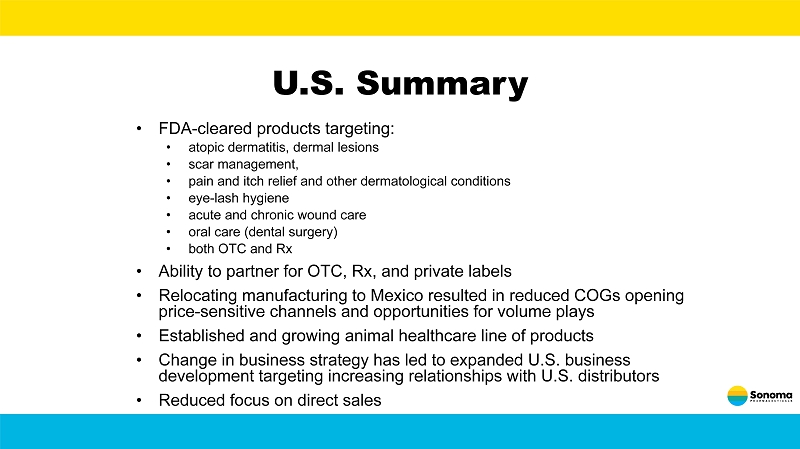

U.S. Summary • FDA - cleared products targeting: • atopic dermatitis, dermal lesions • scar management, • pain and itch relief and other dermatological conditions • eye - lash hygiene • acute and chronic wound care • oral care (dental surgery) • both OTC and Rx • Ability to partner for OTC, Rx, and private labels • Relocating manufacturing to Mexico resulted in reduced COGs opening price - sensitive channels and opportunities for volume plays • Established and growing animal healthcare line of products • Change in business strategy has led to expanded U.S. business development targeting increasing relationships with U.S. distributors • Reduced focus on direct sales

Attractive U.S. Product Offerings

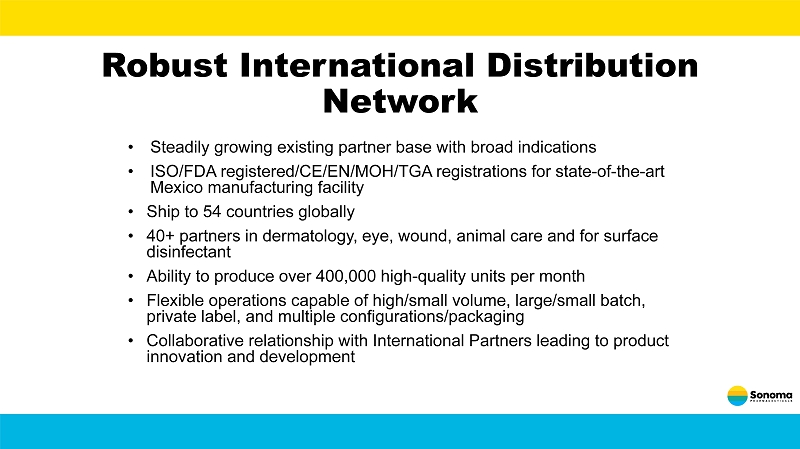

Robust International Distribution Network • Steadily growing existing partner base with broad indications • ISO/FDA registered/CE/EN/MOH/TGA registrations for state - of - the - art Mexico manufacturing facility • Ship to 54 countries globally • 40+ partners in dermatology, eye, wound, animal care and for surface disinfectant • Ability to produce over 400,000 high - quality units per month • Flexible operations capable of high/small volume, large/small batch, private label, and multiple configurations/packaging • Collaborative relationship with International Partners leading to product innovation and development

Europe

Latin America

Asia

Middle East

19 NASDAQ: SNOA Animal Health Care • MicrocynAH ® is a family of advanced animal healthcare products that are safe to use on all animals, no matter the species or age • Perfect for hot spots, scratches, skin rashes and ulcers, cuts, burns, post - surgical sites, irritated skin and lacerations. • We partner with MannaPro Products in the U.S. and Canada • Sold in national pet - store retail chains, farm animal specialty stores, at veterinarians, and mass retailers • Internationally, we partnered with Petagon , Ltd. for the Asia and European sales

Sonoma Partnership Principles • Sonoma seeks long - term strategic partnerships, based on win/win business plans; 50/50 mentality with focus on what’s most important to each side. • Regular in - person and phone meetings to strengthen relationships. • “Do what you say and say what you do” mentality with a high standard of ethical behavior and transparent communication. No hidden agendas. • Sonoma seeks partners with innovative and differentiated technologies or products. Focus on profitable revenue growth consistent with current portfolio.

Accomplishments in 2020 Improved Stock Performance • Market cap of $17.0 @ 12/14/2020 versus $7.6m @ 9/30/2019; stock price doubled year over year Eliminated over $2m of operating expenses per quarter and achieved break - even • Operating expenses of approx. $4m per quarter in 2019 leading to a large capital raise in November 2019 • Restructured in 2020 to cut expenses by eliminating redundant operations in Seattle and Petaluma, relocated U.S. manufacturing to more cost - efficient Mexico facility, and reduced sales force while focusing on profitable business lines • Operating expenses in September 2020 quarter were $2.3m and in June 2020 quarter were $2.9m; goal is to remain profitable with core business operations • Net income for quarter and six months ended September 30, 2020 • Obtained $1.3m in forgivable PPP funding; no dilutive capital raise in over a year Identified Opportunities for Growth • Aggressive and robust pipeline of products • Increased focus on U.S. market • Continued expansion in international markets

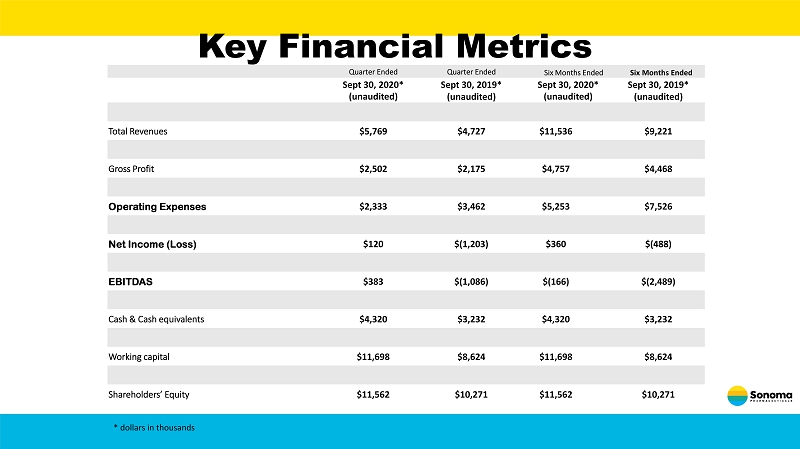

Key Financial Metrics Quarter Ended Quarter Ended Six Months Ended Six Months Ended Sept 30 , 2020* (unaudited) Sept 30, 2019* (unaudited) Sept 30, 2020* (unaudited) Sept 30, 2019* (unaudited) Total Revenues $5,769 $4,727 $11,536 $9,221 Gross Profit $2,502 $2,175 $4,757 $4,468 Operating Expenses $2,333 $3,462 $5,253 $7,526 Net Income (Loss) $120 $(1,203) $360 $(488) EBITDAS $383 $(1,086) $(166) $(2,489) Cash & Cash equivalents $4,320 $3,232 $4,320 $3,232 Working capital $11,698 $8,624 $11,698 $8,624 Shareholders’ Equity $11,562 $10,271 $11,562 $10,271 * dollars in thousands

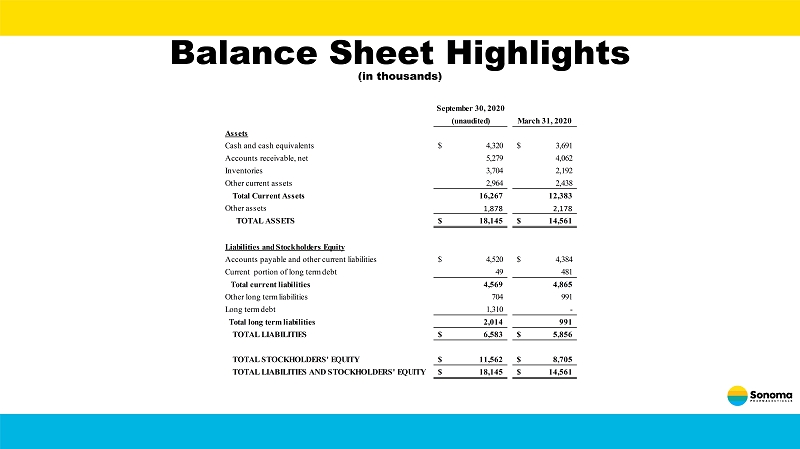

Balance Sheet Highlights (in thousands) September 30, 2020 (unaudited) March 31, 2020 Assets Cash and cash equivalents 4,320$ 3,691$ Accounts receivable, net 5,279 4,062 Inventories 3,704 2,192 Other current assets 2,964 2,438 Total Current Assets 16,267 12,383 Other assets 1,878 2,178 TOTAL ASSETS 18,145$ 14,561$ Liabilities and Stockholders Equity Accounts payable and other current liabilities 4,520$ 4,384$ Current portion of long term debt 49 481 Total current liabilities 4,569 4,865 Other long term liabilities 704 991 Long term debt 1,310 - Total long term liabilities 2,014 991 TOTAL LIABILITIES 6,583$ 5,856$ TOTAL STOCKHOLDERS' EQUITY 11,562$ 8,705$ TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY 18,145$ 14,561$

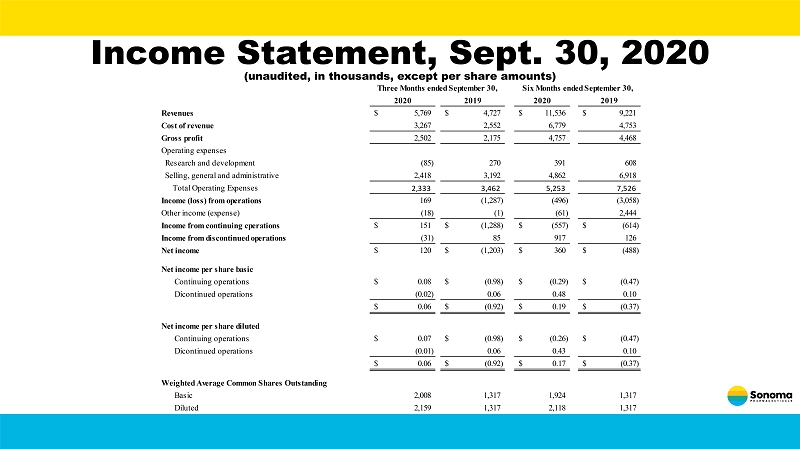

Income Statement, Sept. 30, 2020 (unaudited, in thousands, except per share amounts) 2020 2019 2020 2019 Revenues 5,769$ 4,727$ 11,536$ 9,221$ Cost of revenue 3,267 2,552 6,779 4,753 Gross profit 2,502 2,175 4,757 4,468 Operating expenses Research and development (85) 270 391 608 Selling, general and administrative 2,418 3,192 4,862 6,918 Total Operating Expenses 2,333 3,462 5,253 7,526 Income (loss) from operations 169 (1,287) (496) (3,058) Other income (expense) (18) (1) (61) 2,444 Income from continuing cperations 151$ (1,288)$ (557)$ (614)$ Income from discontinued operations (31) 85 917 126 Net income 120$ (1,203)$ 360$ (488)$ Net income per share basic Continuing operations 0.08$ (0.98)$ (0.29)$ (0.47)$ Dicontinued operations (0.02) 0.06 0.48 0.10 0.06$ (0.92)$ 0.19$ (0.37)$ Net income per share diluted Continuing operations 0.07$ (0.98)$ (0.26)$ (0.47)$ Dicontinued operations (0.01) 0.06 0.43 0.10 0.06$ (0.92)$ 0.17$ (0.37)$ Weighted Average Common Shares Outstanding Basic 2,008 1,317 1,924 1,317 Diluted 2,159 1,317 2,118 1,317 Three Months ended September 30, Six Months ended September 30,

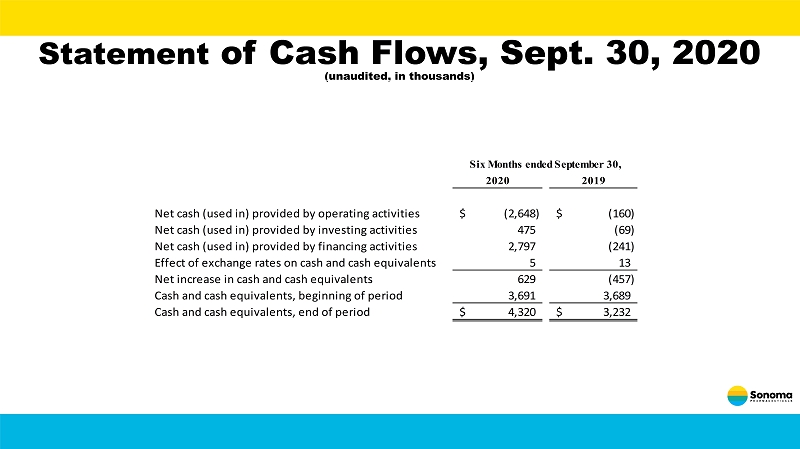

Statement of Cash Flows, Sept. 30, 2020 (unaudited, in thousands) 2020 2019 Net cash (used in) provided by operating activities (2,648)$ (160)$ Net cash (used in) provided by investing activities 475 (69) Net cash (used in) provided by financing activities 2,797 (241) Effect of exchange rates on cash and cash equivalents 5 13 Net increase in cash and cash equivalents 629 (457) Cash and cash equivalents, beginning of period 3,691 3,689 Cash and cash equivalents, end of period 4,320$ 3,232$ Six Months ended September 30,

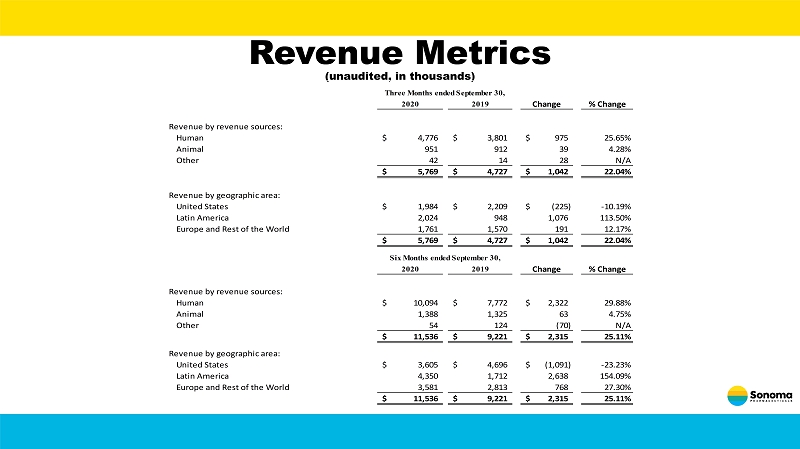

Revenue Metrics (unaudited, in thousands) 2020 2019 Change % Change Revenue by revenue sources: Human 4,776$ 3,801$ 975$ 25.65% Animal 951 912 39 4.28% Other 42 14 28 N/A 5,769$ 4,727$ 1,042$ 22.04% Revenue by geographic area: United States 1,984$ 2,209$ (225)$ -10.19% Latin America 2,024 948 1,076 113.50% Europe and Rest of the World 1,761 1,570 191 12.17% 5,769$ 4,727$ 1,042$ 22.04% 2020 2019 Change % Change Revenue by revenue sources: Human 10,094$ 7,772$ 2,322$ 29.88% Animal 1,388 1,325 63 4.75% Other 54 124 (70) N/A 11,536$ 9,221$ 2,315$ 25.11% Revenue by geographic area: United States 3,605$ 4,696$ (1,091)$ -23.23% Latin America 4,350 1,712 2,638 154.09% Europe and Rest of the World 3,581 2,813 768 27.30% 11,536$ 9,221$ 2,315$ 25.11% Three Months ended September 30, Six Months ended September 30,

Thank You.